Rohan Nest

Abstract: This paper analyses the current state of Sino-Caspian energy cooperation by examining China’s energy relationships with its two major economic partners in the region: Kazakhstan and Turkmenistan. China’s increasing energy demand over the past decades has led to significant investments and cooperation in these countries. Kazakhstan has become a vital trade partner, with China investing in its energy sector and becoming a significant importer of Kazakh oil. Similarly, Turkmenistan has seen China emerge as its primary economic partner due to its vast natural gas reserves. This paper concludes in both sections that despite challenges such as declining trade volumes and competition from other suppliers, China is poised to remain an important stakeholder for both Kazakhstan and Turkmenistan.

Keywords: Caspian, Central Asia, China, energy, energy cooperation, Kazakhstan, natural gas, oil, petroleum, pipelines, Sino-Caspian relations, Turkmenistan

Энергетическое сотрудничество Китая со странами Каспийского региона: анализ опыта Казахстана и Туркменистана

Аннотация: В данной статье анализируется текущее состояние энергетического сотрудничества Китая со странами Каспийского региона посредством изучения энергетических отношений Китая с двумя его основными экономическими партнёрами в регионе: Казахстаном и Туркменистаном. Растущий спрос Китая на энергию за последние десятилетия привёл к значительным инвестициям в эти страны и расширению сотрудничества с ними. Казахстан стал жизненно важным торговым партнёром Китая, который инвестировал в его энергетический сектор и стал крупным импортёром казахстанской нефти. Аналогичным образом, Туркменистан стал свидетелем того, как Китай стал его основным экономическим партнёром из-за его огромных запасов природного газа. В обоих разделах данной статьи делается вывод о том, что, несмотря на такие проблемы, как снижение объёмов торговли и конкуренция со стороны других поставщиков, Китай намерен оставаться важным партнёром как для Казахстана, так и для Туркменистана.

Ключевые слова: Казахстан, Каспийский регион, Китай, нефть, отношения Китая со странами Каспийского региона, природный газ, трубопроводы, Туркменистан, Центральная Азия, энергетика, энергетическое сотрудничество

Introduction: China’s Energy Ties with the Caspian

China’s consistent economic growth in recent decades has transformed the country into one of the top consumers of energy in the world. In fact, the country accounts for 23.6 percent of all primary energy consumption globally.[1] China’s limited domestic oil and gas supplies has prompted it to invest more heavily into oil and gas fields overseas as well as diversifying suppliers.[2] China’s emergence as a prominent actor in the energy sector of Central Asian states, particularly those along the Caspian Sea, has profoundly altered the region’s geopolitical dynamics. The newly established republics in the Caspian region following the dissolution of the former Soviet Union have likewise sought alternative partners to not only reduce their reliance on Russia, but also to expand energy routes and realise their economic objectives through the forging of new ties. Since China mainly relies on energy imports that travel through the Straits of Malacca, which accounts for 80 percent of its oil imports, deepening trade relations with Central Asia is regarded as essential in alleviating potential costs and risks.[3] The over-reliance on energy from the Middle East has also driven China to diversify its source of energy supply by looking to its resource-rich neighbours to the West.[4] The China National Petroleum Corporation’s (CNPC) acquisition of 60.3 percent of oil exploration and exploitation rights over the Zhanazhol Oilfield and other fields from AktobeMunaiGaz in 1997 reflected Beijing’s growing oil demand.[5] This demand could also be witnessed in the construction of the Central Asia-China gas pipeline which began operating in 2009.[6] China’s Belt and Road Initiative (BRI) launched in 2013 further highlights the geographical significance of Central Asia to its energy security interests.[7] With a steady increase of energy trade between China and Central Asia since 2005, China represented a significant portion of 40.9 percent of total exports by 2015.[8] Among the littoral states of the Caspian, Kazakhstan and Turkmenistan’s energy ties with China are the most significant, as they are the primary exporters of oil and gas to China from the region, respectively. This article therefore aims to examine the current status of Sino-Kazakh and Sino-Turkmen energy cooperation, in order to provide insights into the potential trajectory of Sino-Caspian energy cooperation in the future.

Sino-Kazakh Energy Cooperation

Given the strategic importance of Kazakhstan as a trade partner in the diversification of energy supplies, Beijing has been actively involved in the development of the nation’s energy sector since the 90s. The combined reserves of Kazakhstan’s onshore and offshore fields have been estimated to be around “37 billion barrels of oil and 3.3 trillion cubic meters (tcm) of natural gas” in 2013, which places the country among the leading potential producers of oil in the world.[9] Prior to 2003, CNPC invested up to $4 billion in the Aktobe gas field, 60% of which it acquired from AktobeMunaiGas in 1997. Over the next few years, China steadily exerted more control over Kazakhstan’s energy sector as well as expanding its trade relations with the country through major projects. Additionally, China offered a substantial amount of loans to Astana to hasten its economic development. After 2003, Chinese investment in Kazakhstan’s energy sector was accelerated by CNPC’s acquisition of more than a third of the Buzachi North oilfield. CNPC’s purchase of PetroKazakhstan, previously a Canadian company, was also significant due to the company’s ownership of the Kumkol field and its role as one of the top petroleum producers in the country. Additionally, CNPC’s acquisition of more than two thirds of PetroKazakhstan in 2006 and MangistauMunaiGaz in 2009 gave China significant economic leverage. After 2013, CNPC continued expanding with the acquisition of over 8 percent of the North Caspian Operating Company, which further boosted China’s economic presence in Kazakhstan since the company controls the massive Kashagan oil field.[10] With the launch of China’s Belt and Road Initiative (BRI) which aims to link the Eurasian continent with the Middle East and Africa by means of extensive energy and transport infrastructure, Kazakhstan has increasingly become a strategically critical location for China.[11] Its willingness and capacity to sponsor energy-related projects over the years has made the partnership increasingly indispensable for its Central Asian counterpart.

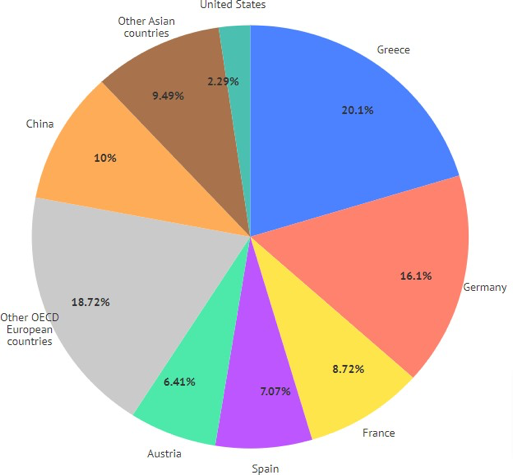

Figure 1. Kazakhstan’s Oil Exports by Country, 2021

Source: generated by the author based on Observatory of Economic Complexity

In recent years, China’s energy partnership with Kazakhstan can be reflected in petroleum and gas trade. Since Kazakhstan mostly depends on oil infrastructure built during the Soviet era, it does not export sufficient oil to China.[12] Furthermore, as Kazakhstan’s oil export destinations are still overwhelmingly the Organisation for Economic Co-operation and Development (OECD) countries of Europe via Russia, it has trouble diversifying its exports to other countries, which in turn limits the potential of Kazakh oil to compete in the international market.[13] Thus, by strengthening energy trade with China, a reliable importer of oil, Kazakhstan hopes to ensure that its oil prices remain competitive in the long-run.[14]Despite a steady growth of bilateral trade between the two countries in the 2000s, there was a stark decline between 2013 and 2019, decreasing by 23% to $21.8 billion. Energy trade was particularly impacted, partly due to China’s economic slowdown and the depreciation of the Kazakhstani tenge. In 2016, Kazakh oil imports only accounted for 0.85% of all of China’s oil imports, which was 3.23 million tons.[15] In 2017, the share of Kazakh oil that was exported to China was a mere 4%.[16] Although the figure of crude petroleum exported to China rose to 10% in 2021 as shown in Figure 1,[17] the level of oil imported to China still clearly lags behind that of Europe. Moreover, there is a discrepancy in terms of the level of trade interdependence between the two countries. Kazakhstan exhibits a significantly higher level of reliance on oil exported to China than China is on oil imports from Kazakhstan.[18]

The share of natural gas exported to China was likewise at a low rate of 5% in 2019. Since half the Kazakhstan electricity needs are satisfied by coal power, the country was able to export some of its natural gas to other countries including China. In 2019, 7bcm out of Kazakhstan’s 55bcm natural gas was exported to China via the Central Asia-China gas pipeline. This figure is considerably small as a share of Kazakhstan’s overall exports. Nevertheless, the trade of gas contributes to Kazakhstan’s economic stability, which in turn benefits China’s domestic security in the bordering Xinjiang province where separatist movements had previously been Beijing’s concern.[19]

China’s important role in Sino-Kazakh energy cooperation is also demonstrated by its many investments and infrastructure projects in Kazakhstan. By 2015, China was estimated to have spent roughly $43.5 billion in the Kazakh oil and gas sector mainly in investments, assets and loans.[20] Chinese companies such as China National Petroleum Corporation (CNPC), Sinopec, and CITIC Limited are heavily involved in the hydrocarbon market of Kazakhstan. It is estimated that over half of Kazakh oil production of around 45 million tons was produced with the involvement of Chinese companies.[21] Examples of such involvement include Sinopec and CNPC’s role in the reconstruction of the Atyrau and Shymkent refineries, respectively.[22] The modernisation of the Shymkent oil refinery has allowed Kazakhstan to boost its yearly refining capacity to 16.5 million metric tons from 13.8 previously, enabling the generation of superior fuel and domestically-produced aviation fuel, instead of depending solely on Russian imports.[23] Chinese companies likewise invested in the development of old sites such as the Kashagan Field in recent years.[24] In 2019, Kazakhstan’s Ministry of Industry and Infrastructure Development (MIID) reported that 20 out of the 55 Chinese infrastructure projects in Kazakhstan were under the Kazakh Ministry of Energy’s purview, [25] highlighting China’s strong emphasis on energy development in Kazakhstan. In terms of pipeline infrastructure, the China-Kazakhstan pipeline and the Central Asia-China (CAC) pipelines built by Beijing were crucial in connecting China to the energy fields of Central Asian states and providing it with an energy source.[26] In 2019, Kazakhstan exported around 10.8 million tons of oil per year (t/y) to China via the Atasu-Alashankou section of the China-Kazakhstan pipeline, which has the capacity to transfer 20 million t/y of oil annually between the two countries.[27] The Beineu-Bozoi-Shymkent gas pipeline, commissioned in 2015 by the Chinese and Kazakh governments, also served to strengthen China’s economic presence in the Central Asian state since it connected China with the Karachaganak, Kashagan and Tengiz gas deposits of Kazakhstan’s Caspian Basin. Moreover, by transporting gas from the western region to the southern region of Kazakhstan, the pipeline alleviates Kazakhstan’s energy deficits and minimises its reliance on gas imports from Uzbekistan. Similar to the pipeline transporting oil from China to Kazakhstan, the gas pipeline between Beineu, Bozoi and Shymkent was intended to facilitate the transportation of gas from both Kazakhstan and Russia to China. The development of additional gas infrastructure as part of energy cooperation between China and Kazakhstan had thus solidified the country’s role as the leading energy transit hub in the region.[28]

Although China invested significantly into Kazakhstan’s oil and gas industry in early years, recent trends show that there has been a decline. China’s share of Kazakh yearly oil production has now decreased to 16% in 2022 down from 31% in 2010. In terms of cumulative investment, the National Bank of Kazakhstan pointed out that this figure has fallen to $1.3 billion in 2021 from $3.7 billion in 2013.[29]

In addition to investments in oil and gas infrastructure, China has also made minimal contributions to the development of power lines in Kazakhstan as part of its development aid to the region.[30] To enhance domestic power generation and transmission, China has acted as the only external investor in projects such as the Moinak hydropower plant and the Dostyk hydro cascade. The BRI has also prompted China to explore Kazakhstan’s renewable energy potential through the development of power lines that stretch from Kazakhstan into China.[31]

Due to China’s growing global influence, Sino-Kazakh energy cooperation has resulted in increased participation of Chinese financial institutions in multilateral development initiatives in Kazakhstan.[32] A contributing factor to this shift in approach is China’s “efforts to tout its international citizenship credentials” in addition to spreading its influence in a more subtle manner through rules-based collaboration with established Multilateral Development Banks (MDBs) such as the World Bank (WB) and the Asian Development Bank (ADB). This recent development is reflected in joint initiatives in renewable energy such as hydropower and solar energy in Kazakhstan. The Commercial Bank of China (ICBC) reportedly works alongside the European Bank for Reconstruction and Development (EBRD), the Asian Infrastructure Investment Bank (AIIB) to finance the Zhanatas 100MW wind power plant in accordance with the Renewables Framework Program of the Kazakh government. In 2018, the prominent Chinese solar energy company Risen Energy was also the sole operator in constructing the 63MW photovoltaic solar plant partially funded by the EBRD in Chalukkurgan, Kazakhstan.

Prospects of Sino-Kazakh Energy Cooperation

In view of the growth of energy cooperation between China and Kazakhstan, many new developments are to be expected. In terms of trade prospects between the two countries, Kazakhstan’s oil exports to China saw a substantial rise of 30% in 2022; however, this trend is unlikely to continue due to China’s preference to purchase discounted Russian oil. Additionally, Kazakhstan intended to reduce the volume of oil it delivers to China.[33] Efforts to ramp up oil exports to the West, in order to take advantage of Germany’s energy demand resulting from the conflict in Ukraine, can be observed. In early 2023, Kazakhstan began transporting oil through the Druzhba pipeline to Germany via Poland. Russia’s oil pipeline company Transneft was contracted by KazTransOil to manage shipment volumes of 1.2 million metric tons to Germany.[34] Despite this apparent westward shift in Astana’s export intentions, it is unlikely to have a substantial impact on its long-term export commitments to China. This is because Kazakhstan’s dependence on Russian pipeline infrastructure for transporting oil westward places the country in a challenging predicament. At first glance, it does not align with the goal of European states to sever their connections with Moscow, nor does it offer any flexibility for establishing alternative transportation routes for Central Asian energy in the foreseeable future. According to some industry experts, Russia’s ability to disrupt Kazakhstan’s main export routes to assert its geopolitical stance cast doubt on the country’s capacity to diversify trade partners.[35] Moreover, Kazakhstan’s reliability as an alternative energy partner to Russia may be undermined by the delay of shipment that occurred in the first fiscal quarter when only 20,000 tons of oil was delivered to Germany, a significantly smaller figure to the expected 300,000 tons.[36] The political risks associated with dependency on Russia and Kazakhstan’s inability to meet European demands thus far suggest that China will remain indispensable as an energy partner.

The renewables energy sector may be another area that suggests a steady rise in energy cooperation between China and Kazakhstan. With small but growing interest from Kazakhstan’s government towards foreign investment in the renewable energy sector, Chinese renewable energy companies have begun to appear on the scene. This can be partly attributed to the renewable capacity of Kazakhstan, which benefits from its status as a nation abundant in natural resources. The Chinese and Kazakh governments have held many joint meetings to facilitate the development of renewable energy. These resulted in the Kazakh authorities’ adoption of several major projects, including ones that produce up to 50 MW.[37] Efforts to expand renewable energy facilities in recent years are reflected in the construction of “a solar power plant in the Almaty region, a wind power plant Zhanatas in the Zhambyl region and a thermoelectric furnace project using YDD ferrosilicon ore in the Karaganda region” in 2021.[38] Moreover, the construction of the Turgusun hydroelectric power station has resumed.[39] Aside from conventional renewable energy, China EximBank also financed an electrolysis plant which produces sustainable hydrogen (H₂) “by splitting water (H₂O).” The steady expansion of China’s renewable energy sector may give it a comparative edge over its other rivals in Kazakhstan and the region at large, including the European Union, the United States and especially, Russia. Recent political pressure from Moscow, urging Kazakhstan to increase its gas imports from Russia,[40] may also encourage Kazakhstan to embrace more investments in green energy from China as a means to reduce its dependence on Russia and traditional energy sources. Thus, the outlook for the future of green energy as a feature of Sino-Kazakh energy cooperation in Kazakhstan is positive. Both nations could reap substantial advantages and participate in the global fight against climate change by implementing effective policy, investment and infrastructure measures towards generating renewable energy.

Despite the positive impact Sino-Kazakh energy cooperation has on Kazakhstan’s diplomatic relations, it has also had an adverse impact on the country’s internal politics due to a general fear of China’s control over its energy resources. By 2020, 25% of Kazakhstan’s oil stocks were Chinese-owned and this figure has been gradually increasing over time.[41] The demonstrations that occurred in Kazakhstan in 2016 over proposed land reforms that would allow foreigners to rent agricultural land in Kazakhstan were partly motivated by fear of the government sale of Kazakh land to Chinese-run companies.[42] Another pressing issue confronting Kazakhstan is its increasing indebtedness to China. Although China’s funding, assistance and investments in Kazakhstan have contributed positively to its economic growth rates, there remains concern regarding the potential political ramifications associated with debt to China. Kazakhstan has obtained substantial loans from China, making it the sixth largest recipient of Chinese loans.[43] Additionally, there are apprehensions about the potential political reliance on China in light of recent occurrences in other countries burdened with debt, such as the financial crises in Pakistan and Sri Lanka.[44] In spite of these difficulties, this energy partnership between China and Kazakhstan is likely to endure, largely due to its significant strategic value for both nations.

Sino-Turkmen Energy Cooperation

Due to Turkmenistan’s role as the main supplier of gas to the east, China has also been forging closer energy ties with the nation since the late 2000s. Estimates according to BP in 2018 suggested that Turkmenistan possesses gas reserves of up to 19.5 tcm, which ranks fourth globally.[45] Increased energy cooperation and the efficient delivery of significant volumes of natural gas from Turkmenistan to China has resulted in it becoming the main economic and trade partner of Turkmenistan. The signing of a General Agreement on Gas Cooperation between the two countries in 2006 strengthened Turkmenistan’s trade relations with China in the post-Niyazov era. This gas agreement allowed CNPC to explore and extract gas reserves in the eastern region of Turkmenistan and prepare for the construction of the Central Asia-China Pipeline. China has become an essential partner in Turkmenistan’s efforts to reduce their dependence on Russia through its diversification strategy. In 2009, the completion of the Central Asia-China Gas Pipeline enabled Turkmenistan to end Russia’s quasi-monopsony of its energy sector.[46] China’s involvement in energy cooperation with Turkmenistan has elevated its importance, owing to its diplomatic clout and increasing appetite for natural gas to fuel its burgeoning economy.

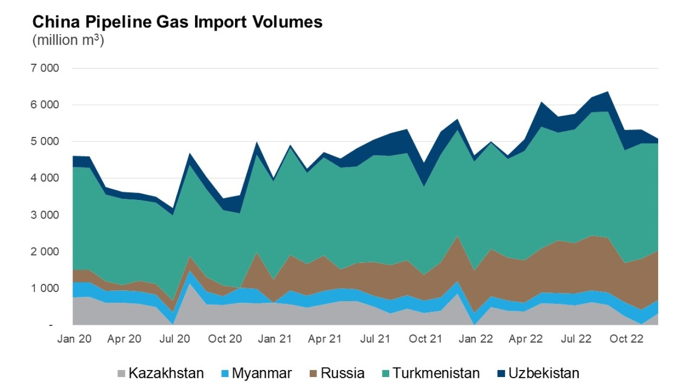

In the past decade, natural gas trade between the two countries has been the most significant feature of Sino-Turkmen energy cooperation. Turkmenistan obtains most of its income from exporting natural gas to China. Having entered Turkmenistan’s gas market in 2009, China initially purchased a substantially lower amount of gas than Russia, its main buyer. In 2010, China acquired less than 5 bcm of Turkmen gas, which lagged behind Russia’s 10 bcm and was slightly less than Iran’s 6 bcm. Nevertheless, China soon surpassed Russia and Iran in 2011 to become the principal buyer of Turkmen gas. By 2018, this figure has risen to 33 bcm.[47] The following figure reflects China’s consistent purchase of Turkmen gas up until October 2022.

Figure 2. China Pipeline Gas Import Volumes

Source: Carnegie Endowment, 2023

Despite these close trade relations, the natural gas sold to China cannot be viewed solely as a source of revenue, as a significant portion of it is used to fulfill the country’s debt obligations to China.[48] Since Turkmenistan’s primary creditor is China, a portion of its debt is likely being paid back through the exchange of gas at current market rates as part of a loan-for-resources arrangement.[49] The exact price of the gas however remains undisclosed due to a lack of transparency.[50] Given the higher cost of Turkmen gas at the time of the agreement, there exists a persistent risk of fluctuating prices and the need to provide additional gas to China to satisfy the debt’s value. This excessive reliance on China has therefore prompted Turkmenistan to seek alternative energy supply routes such as the TAPI pipeline[51] and the Trans-Caspian pipeline.[52]

China’s significant contribution to energy cooperation with Turkmenistan is also evident through its infrastructure projects in the country. China has been offering funding to the Caspian states to aid in the development of energy reservoirs and build up the necessary infrastructure to ensure stable prices for gas imports within the context of oil/gas loan agreements. In 2006, China became a major importer of natural gas, and its demand for the resource continued to rise exponentially, which resulted in an agreement signed between China and Turkmenistan under which China was obliged to provide $29 million in exchange for 30 bcm of gas each year over the next 30 years. Natural gas supplies were then delivered to China via the Central Asia-China gas pipeline launched in 2009. Furthermore, the two sides agreed to develop the Amu Darya River’s neighbouring gas deposits from which the Central Asia-China Gas Pipeline derives its main resources as part of their collaboration in the upstream business. The agreement resulted in initiatives to expand the Central Asia-China Gas Pipeline’s capacity, which included the construction of Line B and Line C. With the completion of Line B in 2010, the feasibility of the 30 bcm/year became evident towards the end of 2011. After the completion of Line C in 2015, the pipeline was able to transport 55 bcm/year to China, which accounted for around 20 percent of the nation’s annual gas consumption. Since these gas supplies allowed China to reduce its dependence on standard coal by around 73 million tonnes, China agreed to the subsequent construction of Line D as shown in Figure 3.[53] Line D is intended to transfer gas from Turkmenistan’s Galkynysh or South Yolotan fields by passing through Uzbekistan, Tajikistan and Kyrgyzstan before finally arriving in Xinjiang’s Wuqia County in China.[54] Currently, the project remains mired in setbacks and postponements over the past few years. However, once this phase is completed, it is forecast to boost the Central Asia-China Gas Pipeline’s overall capacity to 85 bcm/year.[55]

Figure 3. Existing and Proposed Gas Pipelines in Turkmenistan

Source: Gis Reports, 2019

The most important development in relation to investments in the context of Sino-Turkmen energy cooperation in recent years is reflected in a 30-year production sharing agreement (PSA) signed between the two countries in mid-2017. The initiative encompasses significant areas such as the Samantepe gas field, which holds around 5 million tons of gas condensate and 100 bcm of gas. As part of the initiative, Chinese firms quickly worked on activating both old and new production wells located in the Samantepe region, so as to secure and increase the flow of natural gas from the area. Thus far, CNPC has reportedly allocated up to $4 billion in the project.[56]

Prospects of Sino-Turkmen Energy Cooperation

Although Turkmenistan aims to expand its natural gas export markets beyond China in order to reduce its reliance on the country, China is expected to remain its primary customer in the foreseeable future. China’s importance as an energy trade partner was reinforced in June of 2022 when President Serdar Berdymukhamedov highlighted the critical value of the Central Asia-China gas pipeline. [57] This reality is further demonstrated by the recent opening of the gas-storage facility in the Gadyn field in 2022, which forms a section of the vast Bagtyyarlyk oil field currently undergoing development as part of production-sharing pact with CNPC. Berdymukhamedov points to the facility as a significant accomplishment in his efforts to create employment in the country, as it will process 5.5 mcm of gas per day to be delivered to China.[58] Furthermore, Moscow’s efforts to secure the proposed Power of Siberia-2 pipeline (PoS-2) to compensate for reduced gas sales to Europe due to Russia’s operation in Ukraine[59] have given Beijing added leverage over Turkmenistan and its Central Asian counterparts for the prolonged ‘Line D’ project. As Chinese state officials have pointed out, the ‘Line D’ project has been undermined by issues arising from discussions on pricing and technical obstacles.[60] Keen on maintaining economic stability and the flow of revenue from gas sales, Turkmenistan may be more inclined to accelerate negotiations with China by offering more favourable terms in the ‘Line D’ project to ensure that China continues to prioritise it over PoS-2. The Chinese leadership’s eagerness to complete Line D could also be witnessed at the in-person summit of Central Asian leaders held in Xi’an in May during which President Xi Jinping hailed the need to advance the project.[61] China’s willingness to bolster energy ties with Central Asian state as part of the BRI in recent months and its increased leverage to advance Line D due to Moscow’s push to construct its second Siberian pipeline suggest a more robust energy trade relationship between China and Turkmenistan in the long-run.

On the other hand, regular disruptions in the transfer of Turkmen gas in recent years have called the stability of Sino-Turkmen energy relations into question. In the winter of 2017-18, gas delivered via the Central Asia-China gas pipeline to China was reduced by 50% as a result of frequent equipment malfunctions in Turkmenistan. This compelled China to significantly increase its imports of LNG from other countries, causing an unprecedented spike in global LNG prices.[62] Turkmenistan once again halted its gas exports to China due to extreme weather conditions in January of 2023, prompting Ashgabat to implement a new round of constitutional revisions which reinstated former President Gurbanguly Berdymukhamedov and demoted his son.[63] This further fuelled uncertainty regarding the stability of the secretive nation. China’s maritime LNG import capacity may drive competition with land-based pipeline routes, such as those in Central Asian countries, and provide Beijing with a lever over both its gas suppliers and Ashgabat and Moscow. This scenario may likewise prompt Beijing’s partners in the West to push China into making more significant commitments to LNG purchases, in order to give them leverage in their energy dealings with Beijing and deprive Moscow of its revenues amid the Ukraine conflict. These developments could indirectly impact China’s commitment to Turkmen gas imports. While the construction of Line D is increasingly likely, it all hinges on whether Ashgabat has the necessary governance capabilities to deliver the agreed-upon gas volumes. The future trajectory of bilateral trade between China and Turkmenistan will depend on how these challenges are navigated and resolved.

Conclusion

In analysing energy cooperation between China and Kazakhstan, as well as China and Turkmenistan, it becomes evident that China’s role in the Caspian region is poised to endure. This enduring role can be attributed to the contribution that both countries make in partially supplying China’s energy needs, further reinforced by their strategic partnerships within the framework of China’s Belt and Road Initiative. One defining aspect of Sino-Kazakh energy cooperation is petroleum trade. China has been steadily purchasing more oil from Kazakhstan since the early 2000s despite an apparent decline of oil imports in the 2010s. The imbalance of this trade relationship is exhibited by Kazakhstan’s higher level of dependence on oil exports to China than the latter is from Kazakh oil imports.

Another aspect of their partnership is China’s many infrastructure and investment projects in Kazakhstan, which not only developed Kazakhstan’s oil refineries and pipelines, but also enhanced its power line infrastructure. However, China’s share of oil production and its cumulative investments have both declined dramatically in recent years. Despite the positive impact of this energy partnership, China’s preference for Russian oil, and Kazakhstan’s increasing indebtedness pose some political and economic challenges to the Kazakh government. Nevertheless, prospects of Sino-Kazakh energy cooperation remain hopeful due to increased collaboration of Chinese financial institutions with multilateral development banks, especially in the financing of new renewable energy initiatives in Kazakhstan. Moreover, China’s growing interest in developing renewable energy in Kazakhstan positions it as a crucial partner for Kazakhstan’s energy trade, especially as it seeks to navigate geopolitical pressures from Russia.

In terms of Sino-Turkmen energy cooperation, China has gone from being a minor importer of Turkmen gas to becoming Turkmenistan’s main customer in 2011. Due to Turkmenistan’s indebtedness to China, some of the natural gas exported to China is used to fulfil Turkmenistan’s debt obligations. This has prompted Turkmenistan to look to alternative markets. Another aspect of Sino-Turkmen energy cooperation is infrastructure projects. As a result of China’s construction of the Central Asia-China gas pipeline, along with its Line B and C extensions, Turkmenistan was able to deliver large amount of gas to China. While the construction of Line D is increasingly likely, the relationship is not without challenges, as disruptions in gas supply and the need for political stability in Turkmenistan create uncertainties in this energy partnership.

About Rohan Nest

Rohan Nest is a graduate student of Middle Eastern and Central Asian studies at the Australian National University (ANU). His areas of interest include Iran-GCC relations, development studies and regional security issues.

Address for correspondence:

RohanAndrew.Nest@anu.edu.au and rohannest@outlook.com

[1] Qiang Zhou, Ze He, and Yu Yang, “Energy Geopolitics in Central Asia: China’s Involvement and Responses,” Journal of Geographical Sciences 30 (2020): 1878-80.

[2] Zhou, He and Yang, “Energy Geopolitics in Central Asia”, 1878-80.

[3] Zhou, He and Yang, “Energy Geopolitics in Central Asia”, 1882.

[4] Waihong Tang and Elmira Joldybayeva, “Pipelines and Power Lines: China, Infrastructure and the Geopolitical (Re) construction of Central Asia,” Geopolitics (2022): 6-7.

[5] “China-Kazakhstan Energy Relations Between 1997 and 2012,” SIPA Journal of International Affairs, 2016, https://jia.sipa.columbia.edu/china-kazakhstan-energy-relations-1997-2012.

[6] Vladimir Fedolenko, The New Silk Road Initiatives in Central Asia, Vol. 10. (Washington, DC: Rethink Institute, 2013), 13, https://pmworldlibrary.net/wp-content/uploads/2014/09/160419-New-Silk-Road-3.pdf.

[7] “China-Kazakhstan Energy Relations Between 1997 and 2012.”

[8] Zhou, He and Yang, “Energy Geopolitics in Central Asia,” 1881.

[9] Fakhmiddin Fazilov and Xiangming Chen, “China and Central Asia: a Significant New Energy Nexus,” (2013): 40.

[10] Pier Paolo Raimondi, “Central Asia Oil and Gas Industry-The External Powers’ Energy Interests in Kazakhstan, Turkmenistan and Uzbekistan,” (2019): 30-31.

[11] Aghavni A Harutyunyan, “China-Kazakhstan: Cooperation within The Belt and Road and Nurly Zhol,” Asian Journal of Middle Eastern and Islamic Studies 16, no. 3 (2022): 184.

[12] İlhan Sağsen and İshak Turan, “The Role of Kazakhstan in the Energy Security of China,” International Journal of Economic and Social Research 17, no. 2 (2021): 447.

[13] Sağsen and Turan, “The Role of Kazakhstan in the Energy Security of China,” 447.

[14] Sağsen and Turan, “The Role of Kazakhstan in the Energy Security of China,” 448.

[15] Niva Yau, “Tracing the Chinese Footprints in Kazakhstan’s Oil and Gas Industry,” The Diplomat, December 12, 2020. https://thediplomat.com/2020/12/tracing-the-chinese-footprints-in-kazakhstans-oil-and-gas-industry/.

[16] Sağsen and Turan, “The Role of Kazakhstan in the Energy Security of China,” 447.

[17] Observatory of Economic Complexity, “Kazakhstan,” OEC, accessed July 5, 2023, https://oec.world/en/profile/country/kaz?yearlyTradeFlowSele ctor=flow0.

[18] Zhou, He and Yang, “Energy Geopolitics in Central Asia,” 1881.

[19] Sağsen and Turan, “The Role of Kazakhstan in the Energy Security of China,” 449.

[20] Raimondi, “Central Asia Oil and Gas Industry,” 32.

[21] Harutyunyan, “China-Kazakhstan,” 288-89.

[22] Harutyunyan, “China-Kazakhstan,” 288-89.

[23] Janet Xuanli Liao, “China’s Energy Diplomacy towards Central Asia and the Implications on its “Belt and Road Initiative”,” The Pacific Review 34, no. 3 (2021): 497.

[24] Harutyunyan, “China-Kazakhstan,” 288-89.

[25] Linda Yin-nor Tjia, “Kazakhstan’s Leverage and Economic Diversification amid Chinese Connectivity Dreams,” Third World Quarterly 43, no. 4 (2022): 803.

[26] Serik Orazgaliyev, “The Overland Silk Road: China’s Energy Cooperation with Central Asia in the Context of Industry Competition,” China: An International Journal 17, no. 4 (2019): 67.

[27] Sağsen and Turan, “The Role of Kazakhstan in The Energy Security of China,” 449.

[28] Tang and Joldybayeva, “Pipelines and Power Lines,” 18-19.

[29] Almaz Kumenov, “Kazakhstan: Specter of Chinese Control over Oil and Gas Largely Illusory,” Eurasianet, August 24, 2022. https://eurasianet.org/kazakhstan-specter-of-chinese-control- over-oil-and-gas-largely-illusory.

[30] Tang and Joldybayeva, “Pipelines and Power Lines,” 20-21.

[31] Tang and Joldybayeva, “Pipelines and Power Lines,” 20-21.

[32] Morena Groce and Seçkin Köstem, “The Dual Transformation in Development Finance: Western Multilateral Development Banks and China in Post-Soviet Energy,” Review of International Political Economy 30, no. 1 (2021): 190, https://doi.org/10.1080/09692290.2021.1974522.

[33] Tatiana Mitrova, “Q&A | The Geopolitics Behind Kazakhstan’s Turbulent Energy Sector,” Center on Global Energy Policy, May 3 2023, https://www.energypolicy.columbia.edu/qa-the-geopolitics- behind-kazakhstans-turbulent-energy-sector/.

[34] Mitrova, “Q&A | The Geopolitics Behind Kazakhstan’s Turbulent Energy Sector.”

[35] “Kazakhstan still Struggles to Bring Oil across the Caspian,” Vlast, 2023, https://vlast.kz/english/54301-kazakhstan-still-struggles-to-bring-oil-across-the-caspian.html.

[36] “Kazakhstan Exports Oil to Germany as Russia Keeps a Close,” The Jamestown Foundation, 2023, https://jamestown.org/program/kazakhstan-exports-oil-to-germany-as-russia-keeps-a-close-eye/.

[37] Walker Darke, Marat Karatayev, and Rafał Lisiakiewicz, “Sustainable Energy Security for Central Asia: Exploring the Role of China and the United Nations,” Energy Reports 8 (2022): 10742.

[38] Harutyunyan, “China-Kazakhstan,” 289.

[39] Harutyunyan, “China-Kazakhstan,” 289.

[40] Vladimir Afanasiev, “After months of Kremlin political pressure, Russian giant Gazprom finally signs first Central Asia deal”, Upstream, June 19, 2023. https://www.upstreamonline.com/energy-security/after-months-of-kremlin-political-pressure-russian-giant-gazprom-finally-signs-first-central-asia-deal/2-1-1469996.

[41] Togzhan Turganbayeva, “The Impact of Oil and Natural Gas to the Foreign Policy of Kazakhstan,” ESAM Ekonomik ve Sosyal Araştırmalar Dergisi 1, no. 2 (2020): 235-236.

[42] Turganbayeva, “The Impact of Oil and Natural Gas to the Foreign Policy of Kazakhstan,” 235-36.

[43] Srikanth Kondapalli, “Kazakh-China Relations: Balancing in Preventing Regional Domination,” Вестник КазНУ. Серия международные отношения и международное право 101, no. 1 (2023): 20.

[44] Kondapalli, “Kazakh-China Relations,” 20.

[45] Lea Melnikovová, “China’s Interests in Central Asian Economies,” Human Affairs 30, no. 2 (2020): 246.

[46] Akanksha Meena, “Turkmenistan’s Energy Relations with China: a Significant Energy Nexus,” Modern Diplomacy, accessed July 5 2023, https://moderndiplomacy.eu/2022/08/14/turkmenistans- energy-relations-with-china-a-significant-energy-nexus/.

[47] Melnikovová, “China’s Interests in Central Asian Economies,” 245-46.

[48] Invest Foresight, “Foreign Business Penetrates Turkmenistan,” Invest Foresight, accessed July 5, 2023, https://investforesight.com/foreign-business-penetrates-turkmenistan/.

[49] Jakub Jakóbowski and Mariusz Marszewski, “Crisis in Turkmenistan. A Test for China’s Policy in the Region.” OSW Centre for Eastern Studies. August 31, 2018. https://www.osw.waw.pl/sites/default/files/commentary_284_ 0.pdf.

[50] Jakóbowski and Marszewski, “Crisis in Turkmenistan.”

[51] Marat Gurt, “UPDATE 1-Turkmenistan to Start Work on TAPI Pipeline in December,” Reuters, September 15, 2015. https://www.reuters.com/article/turkmenistan-pipeline- idUKL5N11L0RE20150915.

[52] Shahnar Hajiev, “Turkmenistan Should Promote the Trans-Caspian Pipeline More Actively,” Euractiv, September 3, 2019. https://www.euractiv.com/section/azerbaijan/opinion/turkmenistan-should-promote-the-trans-caspian-pipeline-more-actively/.

[53] Stylianos A Sotiriou, “From Monopsony to Monopoly: Russia’s Opening to China as a Stabilising Factor in the Eurasian Energy Trade,” Europe-Asia Studies 75, no. 1 (2023): 37-38.

[54] Tang and Joldybayeva, “Pipelines and Power Lines,” 16.

[55] Sotiriou, “From Monopsony to Monopoly,” 37-38.

[56] Anıl Çağlar Erkan, “The West Alternative in Turkmenistan’s Energy Security,” MANAS Sosyal Araştırmalar Dergisi 12, no. 2 (2023): 707.

[57] Eurasianet, “Turkmenistan: The Beijing Conundrum,” Eurasianet, June 21, 2022, https://eurasianet.org/turkmenistan-the-beijing-conundrum.

[58] Eurasianet, “Turkmenistan: The Beijing Conundrum.”

[59] Chen Aizhu and Marat Gurt, “China Prioritising Turkmenistan,” Reuters, May 24, 2023, https://www.reuters.com/markets/commodities/china-prioritising-turkmenistan-over-russia-next-big-pipeline-project-2023-05-24/.

[60] Aizhu and Gurt, “China Prioritising Turkmenistan.”

[61] Aizhu and Gurt, “China Prioritising Turkmenistan.”

[62] Xuanli Liao, “China’s Energy Diplomacy towards Central Asia and the Implications on its “Belt and Road Initiative”,” 510.

[63] Job Webster, “Perspectives. China Wants the Line D Pipeline. Can Central Asia Deliver?” Eurasianet, February 28, 2023. https://eurasianet.org/perspectives-china-wants-the-line- d-pipeline-can-central-asia-deliver.