Olga Teplova, Andrei Ivanov, Marina Alieva

Abstract: A critical part of the climate agenda is to drive sustainable development in general and ESG-practices of financial markets in particular. International standard-setters and national regulators have professed support for incorporating the issues of climate change into the disclosure standards, acknowledging that a climate plan and/or strategy is an instrument to raise capital in debt markets. The aim of the study is to examine the concept of a climate transition plan and its basic elements as part of a broader climate strategy, while also to evaluate the progress of sampled Russian companies towards developing such climate transition plans (strategies) and disclosing climate-related information. The paper finds a lack of convergence in defining the concepts of a climate strategy and transition plan among Russian companies, as well as insufficient climate-related disclosures in line with national and international requirements. To address these issues, Russian enterprises should continue developing emissions reduction actions, bringing increased transparency to their climate projects, setting robust targets, and improving governance practices within their businesses. Additionally, policy-makers could underpin companies’ efforts by developing a convenient yardstick for defining climate transition plans and strategies that are used in transition debt issuance.

Keywords: climate strategy, climate transition plan, climate-related reporting, climate transition bonds

Разработка планов и стратегий климатического перехода: опыт российских компаний

Аннотация: Климатическая повестка не перестает быть драйвером устойчивого развития, в том числе для финансовых рынков. Международные регламентирующие организации и национальные регуляторы направляют свои усилия на стандартизацию информационных потоков, связанных с климатом, чтобы придать импульс «зеленому» финансированию. Целью исследования является изучение концепции плана климатического перехода и его основных элементов как части стратегии климатического перехода, а также оценка прогресса российских компаний в разработке таких планов (стратегий) и в раскрытии информации, связанной с климатом. Как показал проведенный анализ российских компании, многие из них находятся на разных этапах пути к раскрытию климатических данных, в том числе в формате планов и стратегий. Результаты исследования также указывают на отсутствие единого подхода к определению этих ключевых документов среди компаний в России и на недостаточный уровень раскрытия климатической информации для соответствия требованиям регламентирующих организаций. На практике компании активно участвуют в проектах по снижению выбросов парниковых газов, увеличивая прозрачность климатической информации и совершенствуя системы корпоративного управления. Тем не менее этого пока недостаточно, чтобы выпустить инструменты для управления климатическими рисками, такие как адаптационные облигации и облигации климатического перехода. Написание руководства по составлению климатических планов и стратегий регулятором помогло бы поддержать и систематизировать усилия компаний, открывая для них новые возможности по привлечению финансирования.

Ключевые слова: климатическая отчетность, климатическая стратегия, климатический план перехода, облигации климатического перехода

Intro

UNEP’s latest 2022 Emissions Gap Report (EGP) states that the international community is falling far short of the goals set in the Paris Agreement, with no credible pathway to limit global warming to 1.5°C[1]. According to the study, if current trends hold, global temperatures could rise by 2.8°C by the year 2100. The experts highlight the need for urgent and multilateral actions to address the emissions gap and prevent further negative climate change impacts. The 2022 EGP also underscores the importance of a rapid transformation of such sectors as electricity supply, industry, transportation, buildings, food, and financial systems to achieve the goals set in the Paris Agreement. Similar conclusions are drawn in the State of Climate Action 2022 Report by the Climate Action Tracker (СAT) project.[2]

Although policy makers are in a position to create synergies among companies and to incorporate their climate-related initiatives into policies, strategies and plans, regulatory authorities are not doing enough to support the climate agenda, according to UNEP’s and CAT’s reports. The same is confirmed by the standard-setting organizations, such as the Climate Disclosure Project, that analyze the problem through the corporate lens. In February 2023, CDP published its annual review on whether companies are developing credible climate transition plans. The study shows that in 2022 more than 4,100 organizations disclosed through CDP’s climate change questionnaire that they have already developed a 1.5°C-aligned climate transition plan. These are only one-fourth of the total 2022 reporting sample. Even though the overall tendency is positive, with around 6,500 organizations planning on developing a climate transition plan within two years, such plans may not be having the desired effect. Only a fraction of more than 18,600 organizations – 0.4% or 81 companies – reported sufficient details on all of 21 CDP’s key criteria for a credible climate transition plan.[3] This number might indicate that organizations are having troubles providing high-quality information in their climate-related reporting, which entails another problem also raised by the CAT[4] and other initiatives, like the G20 Data Gaps Initiative[5]: there is a data gap that hinders monitoring and evaluation of the progress made in achieving global temperature targets. Another explanation might be that some companies set this goal as a must-do to keep up with the latest green trends with no robust science-based, strategic planning behind them and no intention to develop one, or that they do not know how to do it properly yet. Either way, it might be reasonable to assume that organizations are in need of further explanation and guidance on developing a robust climate transition plan and increasing the quality of climate-related information disclosures, especially those coming from regulators and the expert community.

The structure of this research is as follows. In the first part, the existing approaches to defining climate strategies and transition plans, as well as the Russian national regulations on the related issues, are analyzed to provide theoretical background and conceptual framework for the study. The second part describes the methodology of the conducted empirical research while the third part outlines its results. In the last part, the overall conclusions and recommendations for the Russian companies on improving their climate strategies and transition plans are given.

Approaches to Defining the Climate Strategies and Transition Plans

The increasing pressure on companies to move from corporate climate commitments and declarations towards credible climate transition plans and strategies is not only external. Domestic policy makers in Russia are also recognizing this trend. It is their responsibility to set up an internal framework with climate-related guidelines and to create favourable conditions for companies and financial institutions to follow it. The Central Bank in Russia (CBR) has professed support for incorporating the concept of sustainability and climate change into the financial market. It also acknowledges an idea that ICMA and other standard-setters that a climate plan and/or strategy is a tool to raise capital in debt markets.[6] Given that, in November 2022 CBR, updated issuance standards by introducing new types of fixed income instruments sustainability-linked, transition bonds, and bonds linked to climate strategy.[7] Among documents regulating issuance of sustainable development bonds in general and the aforementioned three in particular, one can highlight: the National Green Taxonomy[8] and the Regulation of the Bank of Russia N 714-P[9] and 706-P.[10]

As for bonds linked to climate strategy, this is a financial instrument for general corporate purposes, and it might be used for developing green business activities to improve the company’s carbon performance. To issue such bonds, companies should provide the regulator with their science-based climate transition strategy, approved, in most cases, by the board of directors.[11] According to chapter 69(2), section 1.1. of the Russian Central Bank’s Regulation N 706-P, the climate transition strategy consists, inter alia, of the following elements:

- One or more goals set in line with the Paris Climate Agreement, the achievement of which is facilitated by the implementation of the issuer’s climate transition strategy.

- Information about the application of internationally recognised climate change scenarios.

- Description of the issuer’s core and/or most GHG-intensive activities and how they are incorporated into the climate transition strategy of the company.

- Interim and final climate related-targets of the issuer and the time boundaries for achieving these targets, as well as the procedure for determining them. These targets cannot be prompted by the need to comply with national regulations.

- Description of the methodology for setting climate-related targets and the steps that will be undertaken if their evaluation becomes impossible due to circumstances beyond the issuer’s control.

- Description of an action plan for the implementation of the climate transition strategy, including the specified time frame for each step, and monitoring tools, including corporate governance practices.

In order to ensure transparency and accountability, the issuer is obliged to submit an annual report on the progress made in meeting its climate commitments that are articulated in the corporate climate strategy and the decision to issue transition bonds. As sections 1.3 and 1.4 of the same chapter state, progress on climate transition and emissions reduction should be verified by a third party. This third party verification organisation should be a Russian entity qualified by VEB.RF against the requirements set out in the Taxonomy and be included in the national list of verification bodies[12] or a foreign company approved by ICMA or Climate Bond Initiative[13] as an independent verifier. The verification body, whose role is served mostly by rating agencies, publishes an independent statement assuring compliance of the issued bonds with international and national sustainability standards and principles as well as the achievement of interim and final climate performance goals or lack thereof.

However, even though the regulations are in place, as of May 2023, the Russian companies had not issued any climate transition bonds.[14] Director of the Corporate Relations Department of the Central Bank of the Russian Federation Elena Kuritsyna believes that one of the main reasons why Russian companies do not use this type of financial instrument is because “in order to issue such bonds, it is necessary to have an internal sustainable development strategy. It is still difficult for our companies to develop such strategies. They don’t have the experience yet.”[15] Therefore, the Russian Central Bank recently announced that it would prepare a set of recommendations to help companies develop and articulate their climate transition plans and sustainable development strategies.

Even though national soft regulations on developing a valid corporate climate transition plan have not been published yet, there are several international initiatives that have formulated recommendations in this regard, including the International Sustainability Standard Board (ISSB), the Transition Plan Taskforce (TPT), etc. These initiatives deserve approbation for helping companies develop a robust transition roadmap to a low-carbon economy, although several differences in approaches and methodologies do exist. In 2022, the issue of the climate transition plans and their differences was brought up by the group of international standard-setters, resulting in a report that examines the core building blocks for the plan in a variety of metrics. This “Climate Transition Action Plans: Activate Your Journey to Climate Leadership” (hereinafter – CTAP’s research)[16] report brought about a range of documents that guide and shape a credible climate transition plan.[17] As a result of the analysis, the guidance formulated the definition of a climate transition action plan as “a forward-looking list of actions taken in the near term to align internal strategies and external climate and energy policy advocacy to reduce GHG emissions in line with a 1.5°C pathway and achieve a just transition.”[18] For improving the effect on climate plans, companies should disclose specific blocks of information and pay close attention to carbon reduction actions and targets. According to CTAP’s research, the following GHG reduction programmes and actions are outlined:

- Energy efficiency and renewable energy programmes; actions on supply chain emissions reduction

- Waste reduction practices

- Switching fuel and electrification alongside fuel efficiency programmes and/or electrification of transportation and logistics.[19]

The publication also highlights the importance of integrating the transition plan into business strategy and governance. This includes adapting business models, conducting research and development, developing new products and services, and more, while also conducting robust scenario analysis to assess climate-related risks and opportunities, and implementing strong oversight and governance structures.[20]

In 2023, the definitions and elements of the climate strategies and plans were also brought up by ISSB as a part of its IFRS S2 climate-related disclosure standard that is built on the TCFD recommendations. One essential dimension of the standard is how interconnectedness of a climate strategy and transition plan are explained. The standard defines a climate-related transition plan as “an aspect of an entity’s overall strategy that lays out the entity’s targets, actions or resources for its transition towards a lower-carbon economy, including actions such as reducing its greenhouse gas emissions.”[21] According to paragraph 14 of the standard, a climate transition plan should reflect the company’s response to climate-related risks and opportunities in its strategy and decision-making, current and anticipated changes to the entity’s business model, including its resource allocation, to address climate-related risks and opportunities. Additionally, it should include direct and indirect mitigation efforts, information about key assumptions used in developing the transition plan, and underpinning dependencies as well as how the entity plans to achieve any climate-related targets, including GHG reduction targets; and quantitative and qualitative information about the progress of plans.[22] Another piece of the explanatory jigsaw relates to climate strategy. The basic elements of it are given in paragraphs 8 and 9 of the IFRS S2 standard. According to IFRS S2 a climate strategy refers to the approach and actions taken by an entity to manage climate-related risks and opportunities. It also should address the current and potential impacts of climate-related risks and opportunities on the entity’s prospects, business model, value chain, corporate strategy, decision-making and financial performance. When disclosing its climate strategy, the company should specify how such risks and opportunities are integrated into the financial planning process as well as the resilience of the entity’s strategy and business model to climate-related changes and uncertainties.[23]

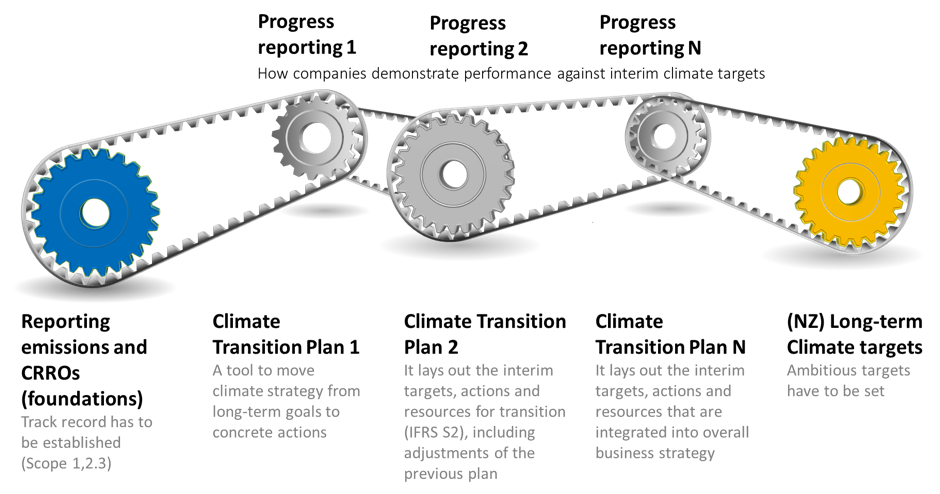

As noted earlier, policy makers are faced with the need to reconcile building blocks of the climate plans and strategies. For companies this means an iterative process of upgrading and adjusting their documents in accordance with the regulatory frameworks, non-binding disclosure standards and own progress reports. Down the road the companies might realize that their initial plan has to be modified to attain long-term climate targets set in the strategy. These updates and changes signify a dynamic, not static nature of transition plans as an integral part of the overall climate strategy. In Figure 1, the key take-aways related to both climate plans and strategies are put together based on the reviewed international initiatives.

Figure 1. Integration of Credible Climate Transition Plans into Climate Strategy

Source: generated by the authors based on CTAP’s Research and IFRS S2 Frameworks[24]

Another framework that will also shed light on climate transition plans and might become a golden standard in the future is the Transition Plan Taskforce. It defines a transition plan as “integral to an entity’s overall strategy, setting out its plan to contribute to and prepare for a rapid global transition towards a low GHG-emissions economy.”[25] According to the TPT Disclosure Framework, a credible transition plan should cover an entity’s high-level climate transition ambitions, including GHG reduction targets; short-, medium- and long-term actions for achieving this strategic ambition and how they will be financed; proper governance and accountability mechanisms; and climate-related risks and opportunities management system that also incorporates the impact on the environment and stakeholders that arise as part of these actions.[26] Even though this framework is still in progress and is not included into Figure 1, it contributes to the understanding of what are the elements of the credible transition plan through the lens of the financial sector that allocates capital.

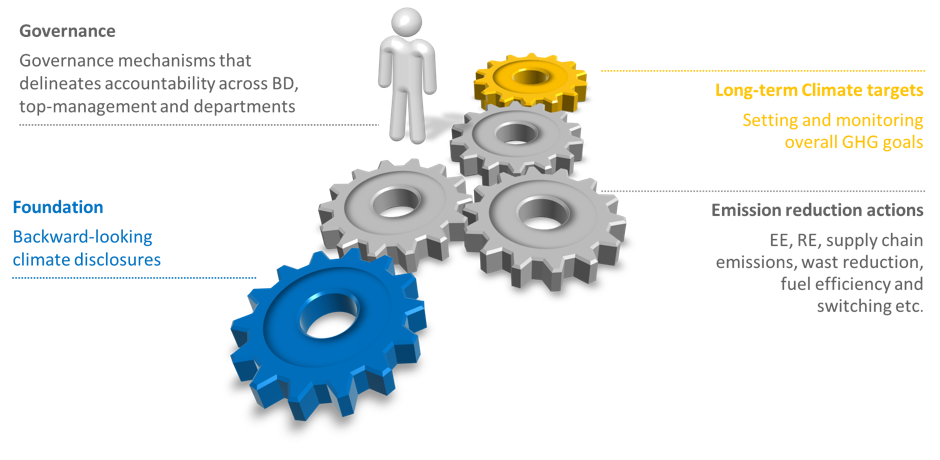

Given the structural similarity of the reviewed initiatives, four core building blocks of transition plans that are also part of climate strategies have been identified for the purpose of this research paper (Figure 2). Integration of these blocks results in higher credibility of climate plans and strategies, as well as in better-informed decisions of their users according to international standard-setters. At the same time, the list of the blocks and their elements is not exhaustive and can be adjusted to the needs of other research papers.

Figure 2. Building Blocks for the Climate Transition Plan as a Part of Climate Strategy

Source: generated by the authors

The overarching aim of this research paper is to contribute to the understanding of the climate transition plan as a part of overall climate strategy, including its basic elements. In addition, this article is aimed at scrutinizing climate disclosure practices of Russian companies to find out whether they comply with the recommendations of the standard-setters. A number of Russian companies voluntarily disclose climate-related information. However, due to limited environmental disclosure requirements,[27] including those on climate performance, and the lack of nationally determined methodologies,[28] market participants are implementing disclosure practices at their own discretion. However, is such disclosure sufficient to comply with the criteria of best practices and requirements of the IFRS S2 standard, which is being adapted in the international arena and by the Central Bank of Russia?

Two research questions are put forward:

- Is there any convergence among the Russian companies on what concepts of climate strategy and transition plan stand for?

- Do the Russian companies disclose climate-related information in a systematic and sufficient way that complies with the requirements of the Russian Central Bank and international frameworks?

Methodology

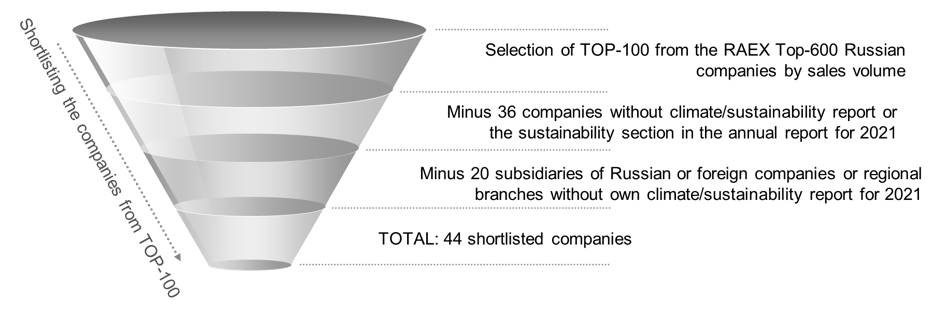

To sample companies for research purposes, the tiered screening approach has been applied with the following criteria for each tier:

- Tier 1: Companies that are listed in the RAEX Top-600 by sales volume as of November 24, 2021

- Tier 2: Companies that are in the TOP-100 companies from the RAEX Top-600

- Tier 2: Companies that have a climate/sustainability report or the sustainability section in its annual report for 2021

- Tier 3: Separate companies and subsidiaries or regional branches that report on climate/sustainability performance within their own boundaries.[29]

In the end, there are only 44 companies out of the initial tier left for further in-depth analysis (Figure 3).

Figure 3. Shortlisting Process and Results

Source: generated by the authors

The climate-related information disclosed by the remaining 44 entities in their sustainability reports and in the sustainability section of their annual integrated reports has been analyzed by applying the set of criteria based on international best practices mentioned in the introduction adjusted to the maturity level of sustainability and climate-related disclosure by the Russian companies.[30] This set includes the following elements (criteria) that are divided into four blocks:

- Governance: climate policy, board of director’s oversight, climate performance remuneration

- Foundation: use of TCFD/CDP frameworks, scenario analysis, backward-looking emissions disclosure (Scope 1, 2, 3)

- Long-term Climate targets: science-based and long-term emissions reduction targets, scope 3 targets

- Emission reduction actions: forestry, energy efficiency, renewables, fuel switching and waste reduction programmes; green products; climate-related financial instruments.

It’s worth reiterating that there are various perspectives on what blocks and elements the plan and strategy should consist of and have in common. In this article, attention is paid to the requirements of the Russian Central Bank, CTAP’s research, and the voluntary IFRS S2 standard, which was developed in accordance with the expectations of the financial sector actors discussed above.

Results

Governance

Does the company have a climate change policy? If not, are climate-related issues covered in corporate sustainability or environmental policy?

25 out of 44 companies have climate-related aspects covered by corporate policies. 13 of them, or 30% of the total, have a corporate climate policy as a specific document that reflects the company’s position on climate change, elaborates on its approach for current activities and further actions, and articulates some relevant commitments. At the same time, there is no unanimous approach for naming the document. Among the most frequently met titles are: “Climate Policy”, “Company’s Position on Climate Change” and “the Environmental Policy on Climate Change”. However, the title itself seems to have no correlation with how the document is structured and detailed. 12 companies, or 27%, have environmental or sustainability policies that describe, varying in detail and quality, the company’s intentions, commitments, and/or measures aimed at combating climate change and/or mitigating its negative impact, i.e. they incorporate climate-related issues into the environmental ones with little or no distinction between them.

Does the company’s board of directors oversee climate-related issues and/or activities?

There is a member or a committee at the board of directors level responsible for overseeing climate-related issues and corporate climate performance in 23 companies. Generally, the main aspects to keep track of at the senior management level are carbon emission reduction and climate risks.

Does the company’s remuneration system incorporate KPIs that are tied to climate and/or environmental performance?

15 companies have set climate or environmental KPIs that are tied to the remuneration system for either top- or middle-level managers. The common practice would be to set such performance indicators for the board members nominated to be responsible for climate change oversight or for the chief sustainability officer.

As for the corporate governance of climate-related issues, the analysis has shown that 25 sampled companies, or 57%, disclose sufficient information on one or more aspects regarding climate governance practices. 12 of these 25 companies, or 27% of the total number, meet all three climate governance criteria. Surprisingly, one company does not have a climate policy, although showing very high performance on the other two criteria in this category as well as in the others.

Foundation

Does the company use the TCFD Recommendations when reporting on climate change and/or submit the CDP Questionnaire?

24 companies, or 55%, apply the TCFD Recommendations and/or CDP when reporting on climate change. However, the use of these reporting frameworks does not guarantee the quality of disclosures that vary among sampled Russian companies.

Does the company use one of the internationally recognised climate scenarios (e.g. IPCC SR 1.5) or one of their own?

The overwhelming majority of frameworks and standards on climate-related disclosure and climate transition plans, including the new IFRS S2 on climate-related disclosure, ICMA,[31] CTAP’s research, put a strong emphasis on conducting climate scenario analysis for a robust transition strategy. However, only 17 out of 44 companies, or 39%, mention using scenario analysis in their reports. As a common practice, companies apply the three IPCC scenarios (SSP1-2,6, SSP2-4,5 and SSP5-8,5) and base their assumptions on them. The SSP2-4,5 2°C scenario is more likely to be used as a dominant one.

Does the company disclose its Scope 1, 2 and 3 absolute emissions and/or carbon intensity metrics for the last three years?

34 companies, or 77%, report their emissions, but to different extents. 12 companies, or 27%, disclose all three scopes of emissions and/or carbon intensity metrics for the last three years. 13 companies report on both scope 1 and scope 2 emissions, but do not report scope 3. Finally, 9 companies disclose only their scope 1 emissions.

Does the company disclose its Scope 3 emissions?

19 companies out of 44, or 43% of the total, disclose their Scope 3 emissions. It should be mentioned that the “yes or no”- type of questions used in our research suits the purpose of showing a big picture of climate-related practices among the top Russian companies, but does not enable us to make a thorough and in-depth comparison. For instance, some companies provide detailed and comprehensive calculations of their scope 3 emissions, while others indicate only the final number of emission volumes.

Overall, in the foundation block, 10 companies, or 23% of the final sample, fully meet all four criteria. Only 2 companies, or 5% of the total, met just one criterion in the foundation block. Although more than half of the sampled companies adopted the global baseline for climate disclosures (TCFD, CDP) and built on it, there is still room for improvement.

Long-term Climate Targets

Has the company set science-based emissions reduction targets approved by the Science Based Targets Initiative?

Only 4 companies, or 9%, have set climate targets in accordance with the Science Based Targets Initiative. On top of that, 3 companies announced their intentions to set such emission reduction targets in the foreseeable future.

Does the company have medium and/or long term emissions reduction targets (beyond 2025)?

19 companies, or 43%, on the list set long-term reduction targets, and some of them mention reduction plans up to 2050. These targets also vary in quality and detail, limiting the ability of external users of information to evaluate their consistency and credibility.

Has the company set the Scope 3 emissions target?

Only 2 companies from the list set their Scope 3 emissions target. This is significantly lower than the number of companies that report their actual data on Scope 3 emissions.

Overall, despite a fairly high proportion of sampled companies reporting on CO2 emissions and climate action, a very small percentage actually set science-based emissions reduction targets and Scope 3 goals, and less than a half of the sample set medium and long-term reduction targets. As a result, only 2 companies meet the full criteria in the long-term climate targets block.

Emission Reduction Actions

Does the company have any offset or forest fire protection projects in its portfolio?

Although companies that elaborate on the physical climate risks associated with their business operations often mention the danger of forest fires, only 11 companies, or 25%, report their actions towards decreasing forest fire hazards. Forest-based carbon offsets also have limited application among the sampled companies.

A number of companies report on the adoption of plans of organizational and technical measures to ensure fire safety at production facilities, paying attention to the safety of forest funds on the territory adjacent to the company’s facilities. Such plans include both technical fire-fighting drills and personnel training activities. Some companies report on more specific actions, such as replacing overhead high-voltage power lines with underground cables to minimize fire risks.

Does the company participate in any green sectoral initiatives and/or have green certificates?

29 companies, or 66%, participate in green sectoral initiatives, having received green certification, including international ones. For instance, the Russian mining companies actively participate in ICMM (International Council on Mining and Metals). Most common green certifications received by the sampled companies are FSC (Forest Stewardship Council) and LEED (Leadership in Energy and Environmental Design).

Does the company have a renewable energy programme in place?

Russian companies, while acknowledging renewable energy as a decarbonization solution, put limited effort to implement these types of mitigation projects. More than half of the companies in the final sample declare that they have projects on developing and implementing renewables (29 companies or 66%), but do not elaborate in more detail on actual emission reductions from these projects and investment volume of them.

Companies report on the energy consumption structure, specifically noting that the growth in renewable energy consumption is associated with the replacement of traditional generation means by solar and wind power plants. Some companies also support hydropower development projects.

Does the company implement circular economy practices?

In addition, 26 companies, or 59% of the final sample, support initiatives on the circular economy, considering waste management and production of recyclable goods. Some metallurgical and oil and gas companies declare the processing of secondary raw materials and the subsequent profit from the sale of recycled waste. Companies in other sectors, such as technology and transport, are placing more emphasis on the implementation of circular economy practices as part of their green office programs: they encourage separate waste collection by employees and customers, send waste for recycling, and use environmentally friendly consumables.

Does the company have an energy efficiency programme in place?

Almost all of them – 41 companies or 93% – do have programs for increasing the energy efficiency of their businesses. Since companies disclose information about energy efficiency programs only partly, it is difficult to evaluate the effectiveness of these energy efficiency measures and projects. The point is that information about activities in this area is qualitative rather than quantitative, and often is not enhanced by specific goals or KPIs.

Does the company have a programme for switching its operations to lower-carbon fuel?

25 companies have changed part of their business operations to lower-carbon fuels such as natural gas or biofuel. Although the Russian government has programmes supporting such initiatives, not all companies claim their readiness to continue switching from gasoline. There are examples of companies that take action toward the replacement of traditional fuels with LNG or biofuel as a part of larger climate action programmes or green initiatives. However, in several cases, the increase in gas fuel consumption is associated with the rise in overall consumption of fuels, including gasoline. Moreover, there is a case of a company that has suspended the greening of fuel mix, since it is not economically viable at the moment.

Does the company have a green product line and/or disclose the profit gained from selling green products?

Although 15 companies have developed a range of green products, they do not earmark green revenues generated from the sales of these products in most cases. At the same time, several energy companies report production of low-carbon fuels, as well as profits from the use of energy from renewable sources and equipment for electric vehicles. Companies in the chemical sector also mention environmentally friendly products such as organic fertilizers. Retail sector reports on the production of recycled goods.

Does the company have financial products linked to climate performance in its portfolio?

Banks are reluctant to disclose information on green products by client; therefore, an emphasis is placed on green bonds in the research. As for bond market, it provides limited funds for the Russian companies to address the climate-related issues. There are only 2 companies among those sampled companies that have experience in attracting investments through the issuance of sustainable debt instruments that fall under the criteria of the Moscow Stock Exchange.

Overall, a fairly large number of companies report on various programs and projects in the field of emission reduction. Nevertheless, companies face a degree of difficulty in creating a portfolio of mutually reinforcing and comprehensive mitigation options. Only one company from our sample meets the full set of criteria identified in the block. Part of the answer might lie within the area of sector-specific business activities that are mirrored in emission reduction projects and impose some limitations on scope of mitigation options. However, most companies have energy efficiency, renewable energy and circular economy programs in place.

Conclusion

If we were to summarize the climate-related disclosures of Russian companies, answering the first research question, it appears that one of the barriers inhibiting consistent reporting on the implementation of carbon reductions is a lack of convergence among the sampled companies in defining the concepts of climate strategy and transition plan. This confusion has far-reaching implications for external users of climate-related information, especially for financial institutions that provide funds for carbon-reduction projects and need to monitor progress against targets. These conclusions are aligned with the results of CTAP’s research. It has also shown that there is confusion among market participants regarding the core elements of the transition plans and strategies. In many cases, companies do not distinguish climate plans from goal setting. For instance, many companies rely on the SBTi as their main source of guidance, despite it being a GHG target setting and validation platform.[32] The abundance of various transition plan guidance documents makes this task even more challenging. Lack of convergence in definitions is exemplified also by RAEX’s ESG Ranking “RAEX Top-50 Climate”. It analyses climate policies and programmes on CO2 emission reduction, not discerning the difference between plan and programme. At the same time, RAEX indicated that companies’ commitments placed in formal documents are not sufficient to reach goals on cutting emissions. In other words, the gap between the goals set and the actual effects does exist.

An answer to the second research question cannot be decoupled from the first one, since the lack of convergence in defining the climate strategy is inextricably linked to limited compliance with standards and recommendations. Despite visible efforts by Russian companies from the TOP-100 RAEX to comply with the disclosure requirements of the Russian Central Bank or international frameworks, the immediate outlook remains divergent. More specifically, if companies follow any standard, they tend to use the framework proposed by TCFD or CDP. The sampled companies, in an attempt to comply with standards, find themselves in a mire of soft regulation. Consequently, this results in the absence of a baseline for climate-related disclosures. Not surprisingly, less than half of the companies in the sample provide information on the criteria identified for the research purposes. The most disclosed criteria (more than 50% of companies) relate to the actions that companies direct to reduce their carbon footprint, such as energy efficiency programs, the development of renewable energy sources and the implementation of the principles of the circular economy. In addition, slightly less than 40% of companies use scenario analysis based on both existing research and their own calculations.

The results of current research are sending an unequivocal message that without transparent climate strategy, transition plans and settled goals, such actions cannot be considered as sufficient. To comply with the requirements of the national regulator and international organizations, Russian industries should elaborate further on setting long-term climate action plans and specific goals, developing a stronger foundation for their climate action as well as implementing the practice of environmental and climate governance within their businesses. To assist companies in wading through innumerable recommendations and standards, Russian policy-makers can create by setting a set of national definitions and criteria for a credible transition plan and climate strategy based on international best practices.

About the authors

Olga Teplova is a Lead Researcher at the Research Center for Energy Policy and International Relations (ENERPO), EUSPb. Her research interests include ESG disclosure standards, climate and sustainable finance, climate risks and opportunities.

Andrei Ivanov is a Jr. Research Fellow at the ENERPO Research Center, EUSPb. His research interests include sustainability reporting, energy policy, sustainability in HEIs.

Marina Alieva is a PhD student at the Department of Political Science, EUSPb. Her research interests include energy policy, energy security, EU-Russia relations.

Addresses for correspondence:

oteplova@eu.spb.ru, anivanov@eu.spb.ru, malieva@eu.spb.ru

[1] UNEP, Emissions Gap Report 2022: The Closing Window — Climate Crisis Calls for Rapid Transformation of Societies, 35-36, https://www.unep.org/emissions-gap-report-2022.

[2] Sophie Boehm et al., State of Climate Action 2022 Report, 2022, 160, https://climateactiontracker.org/documents/1083/state-of-climate-action-2022.pdf.

[3] CDP, Are Companies Developing Credible Climate Transition Plans?, 6-8, https://cdn.cdp.net/cdp-production/cms/reports/documents/000/006/785/original/Climate_transition_plan_report_2022_%2810%29.pdf.

[4] State of Climate Action 2022 Report, 9-10.

[5] IMF, G20 Data Gaps Initiaive 3: Workplan. 2022, 5-13, https://www.imf.org/-/media/Files/News/Seminars/DGI/Home/g20-dgi-3-workplan-people-planet-economy.ashx.

[6] ICMA, Climate Transition Finance Handbook, 2023, https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/climate-transition-finance-handbook/.

[7] INTERFAX.RU, “Bank Rossii s 28 Noyabrya Rasshirit Linejku Obligacij Ustojchivogo Razvitiya,” November 17, 2022, https://www.interfax.ru/business/873007.

[8] The Russian Government, The Government Decree No. 1587 of September 21, 2021, On Approval of Criteria for Sustainable (Including Green) Development Projects in the Russian Federation and Requirements for the Verification System for Sustainable (Including Green) Development Projects in the Russian Federation, 2021, http://government.ru/docs/all/146531/.

[9] Central Bank of Russia, The Regulation of the Bank of Russia dated March 27, 2020, N 714-P “On Disclosure of Information by Issuers of Equity Securities”, 2020, https://www.cbr.ru/Queries/UniDbQuery/File/90134/1038.

[10] Central Bank of Russia, The Regulation of the Bank of Russia dated December 19, 2019, N 706-P (ed. dated July 4, 2022) “On Standards for the Issue of Securities”, 2019, https://www.cbr.ru/Queries/UniDbQuery/File/90134/1030.

[11] Svetlana Bik, “Adaptaciya, Klimaticheskiy Perehod i Slb Po-russki,” Climate Change Moscow, November 22, 2022, https://climate-change.moscow/article/adaptaciya-klimaticheskiy-perehod-i-slb-po-russki.

[12] “List of Verifiers Approved by VEB.RF,” VEB.RF, 2022, https://xn--90ab5f.xn--p1ai/en/sustainable-development/green-finance/national-competence-center/?tabs=verifiers_and_bond_issues.

[13] “Approved Verifiers under the Climate Bonds Standard,” Climate Bonds Initiative, https://www.climatebonds.net/certification/approved-verifiers.

[14] Prime, “CB Vypustit Rekomendacii po Formirovaniyu Strategii Klimaticheskogo Perekhoda,” May 18, 2023, https://1prime.ru/business/20230518/840630345.html.

[15] Prime, “CB Vypustit Rekomendacii po Formirovaniyu Strategii Klimaticheskogo Perekhoda.”

[16] CDP, Ceres, the EDF, Climate Transition Action Plans: Activate Your Journey to Climate Leadership, 2022, 3, https://www.wemeanbusinesscoalition.org/wp-content/uploads/2022/10/WMBC-Climate-Transition-Action-Plans.pdf.

[17] Reviewing 31 transition plan guidance documents from 17 organisations and surveying over 100 companies, investors, and other stakeholders worldwide to benchmark relevant practices and identify common core transition plan elements.

[18] Climate Transition Action Plans: Activate Your Journey to Climate Leadership, 4.

[19] Climate Transition Action Plans: Activate Your Journey to Climate Leadership, 7.

[20] Climate Transition Action Plans: Activate Your Journey to Climate Leadership, 8.

[21] ISSB, IFRS S2: Climate-related Disclosure, 2023, 19, https://www.ifrs.org/content/dam/ifrs/publications/pdf-standards-issb/english/2023/issued/part-a/issb-2023-a-ifrs-s2-climate-related-disclosures.pdf?bypass=on.

[22] IFRS S2: Climate-related Disclosure, 8-9.

[23] IFRS S2: Climate-related Disclosure, 7.

[24] CRROs – Climate-related risks and opportunities. NZ – net zero.

[25] TPT, The Transition Plan Taskforce Implementation Guidance, 2022, 6, https://transitiontaskforce.net/wp-content/uploads/2022/11/TPT-Implementation-Guidance-1.pdf.

[26] The Transition Plan Taskforce Implementation Guidance, 6.

[27] Ellie Martus and Stephen Fortescue, “Russian Coal in a Changing Climate: Risks and Opportunities for Industry and Government,” Climatic Change, no. 173 (2022):25, https://doi.org/10.1007/s10584-022-03420-0.

[28] Svetlana Vozykova and Yuri Kustikov, “Current Trends and Key Limitations of Climate-Related Disclosure by Russian Companies,” IOP Conference Series: Earth and Environtal Science, no. 866 (2021): 6, https://doi:10.1088/1755-1315/866/1/012030.

[29] There is one example of an international corporation with a branch in Russia that issues annual sustainability reports within its boundaries and one example of a Russian subsidiary that publishes its report separately from the parent company.

[30] The only exception is Magnitogorsk Iron & Steel Works. The company discloses its climate-related information for 2021 on the website: MMK, Information Disclosure, 2021, https://mmk.ru/ru/sustainability/ecology/environmental-management/.

[31]ICMA, Climate Transition Finance Handbook. Related Questions, 2020, https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/CTF-Handbook-QA-09122020.pdf.

[32] Climate Transition Action Plans: Activate Your Journey to Climate Leadership, 3.